What is XM’s CFD trading? The difference between CFD trading and Forex trading

What is CFD?

CFD is short for “Contract For Difference", which is referred to as “trading/arbitrage contract".

Are common name for financial products that can be invested in such as foreign exchange, stock, equity indices, crude oil or metals …

Therefore, Forex (Forex) is one of the CFD. Any product that conducts a differential payment using a the same deposit except for foreign exchange.

The difference between CFD and Forex

Forex is one of the CFDs (contract for difference), but the three points below are three major differences between Forex and other CFD financial products.

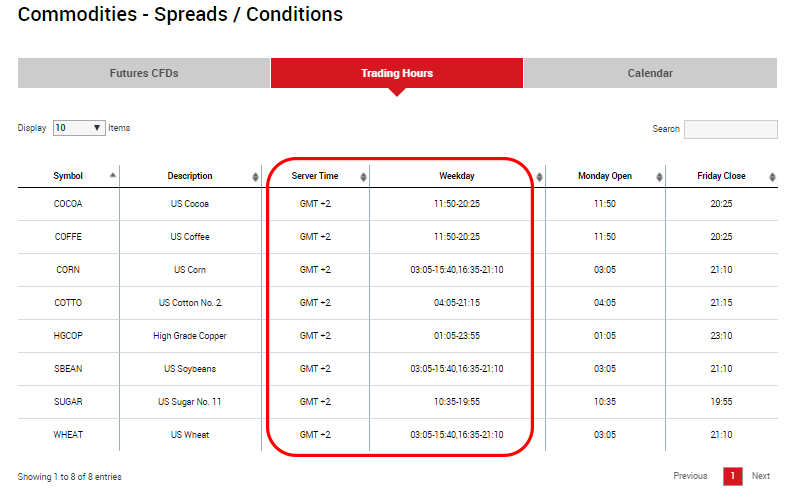

Trading hours

Forex, can be normally traded 24/7 but other CFD trading cannot be traded 24/7.

You can confirm from “trading hours" on each tab “Goods", “Securities", “Precious Metals", “Energy" on trading instruments on XM Group website.

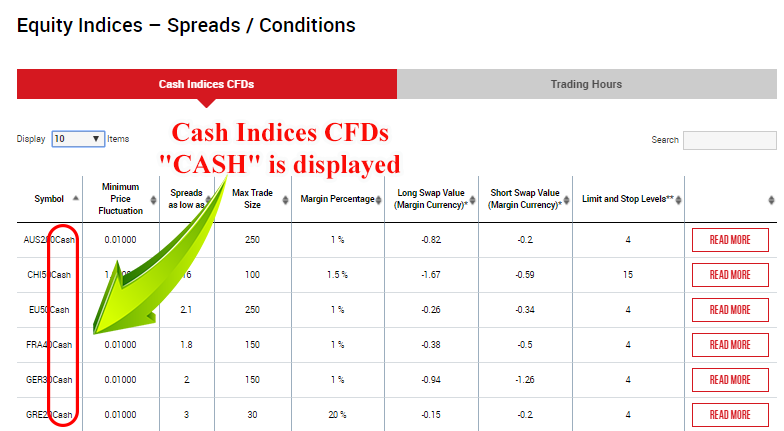

Future indices CFDs, Cash indices CFDs

There are two types of indices CFD tradings: future and cash. In Forex, there is no concept of the future and the cash.

“Future" is one of the derivative products, the future price of that commodity for a given term.

The Equity Indices, such as the Nikkei 225, are categorized as futures and cash indices.

Although they are the same goods, prices in the future and cash are more or less different.

Also, you need to note that in the case of CFDs, the cash indexes will depend on the dividend adjustment, but in the case of selling Cash indices CFDs, dividend adjustment will be factored in.

Perhaps the Forex beginners will find it difficult but at the beginning you only need to remember “CFD future has a trading term", “CFD cash doesn’t have a trading term" is so.

In the case of XM Group, Nikkei 225 cash index is displayed as “JP225 Cash" at MT4. Indices are not displayed as “Cash" are futures indices.

Related articles:How to solve in case you can not display the chart because the the screen shows “waiting for MT4 chart update"

Different ways to calculate deposit

In the case of Forex trading in XM Group, you can calculate with leverage up to 888 times, as for CFD trading, the formula does not involve the deposit associated with the used leverage level.

Regardless of the leverage level of the setup account, the formula will be “Lot size × contract size × order opening price × deposit percent”.

I will introduce a CFD deposit calculation form in the article below.

Related articles:How to calculate the required margin related to XM’s CFD instruments

The main indices of a CFD traded in XM Group and the characteristics of each CFD

Commodity

The commodities mentioned are products like soybeans, corn, sugar, coffee, cocoa. You can trade agricultural products such as cereals.

When bad weather happens at cropping areas, production volume is likely to decrease, there will be a tendency to increase the price of that commodity.

In addition, the price of commodities will fluctuate due to major factors such as world demand and supply, political and economic situation or market trend of the dollar.

Equity Indices

You can trade major stock index around the world.

Major equity indices indexes include weighted average of Nikkei,NY Dow Jones, NASDAQ, etc. These are the indexes that people hear frequently on even the Vietnamese economic news.

In addition, you can trade equity indices of countries such as Germany, France, China or Singapore, …

Precious Metal

Three types of precious metals can be traded Gold, Silver, Platinum.

Trading gold has been favored by investors. Many investors tend to buy gold as a way to avoid risk due to the highly volatile trend of the US dollar.

Energy

You can trade the following energymixed oil, London light oil, crude oil, natural gas, …

If there was an big expectation on the world’s economic growth,

Furthermore large price movements are dependent on the situation of the countries producing energy such as crude oil or gas, … and weather conditions. In the two years from 2014 to 2016, crude oil has fallen by about 40% due to economic instability.

Some advantages of CFD

CFD is different from FX in that it does not calculate deposit using leverage but it can be effectively traded with less investment. This is the advantage of CFD.

In case of regular commodity trading other than CFD, you can not trade without a large amount of money, but in CFD it is possible to trade with a small capital.

Of course, the CFD can be used as a hedge – to avoid risks, to ensure the existing assets for USD transactions or risk mitigating transactions such as index funds (a type of trust investment) as it can start trading from “Sell” much like Forex.

In comparison to the Forex currencies, commodity has an additional advantage that it is easy to see the world’s demand for each commodity.