Leverage mechanism

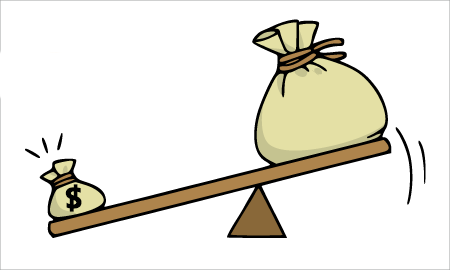

By increasing your leverage, you will be able to move a large amount of money, and you have learned high risk- high return.

So, What are“Increase leverage”, “Decrease leverage” like?

This article introduces more specifically the leverage mechanism.

Also, you do not need to understand this step at this stage. Now you can trade on demo accounts to practice.

Depending on the FOREX company, the maximum leverage will vary

First,each FOREX company determines the maximum leverage that can be provided.

Company A leverages up to 100 times, company B leverages up to 300 times, company C leverages 500 times, similarly, the maximum leverage that company provides can be different. (You can check the maximum leverage on the FOREX trading website.)

Also, among FOREX trading companies, “XM" is the company that offers the highest leverage of 888 times.

This means that you can trade within this maximum leverage.

Notes for trading with high leverage

If the transaction is close to the maximum leverage level, only with a negative change in the exchange rate could cause loss. In trading terms, this is called Stop Out.

This is a mandatory payment mechanism due to trading above the maximum leverage that the FOREX trading company provides. (In more detail, The margin level is lower than the fixed rate.)

In order for the funds in your account to be non-negative, the FOREX trading company will automatically process to secure the client’s fund

So, in practice, in order to avoid being forced to pay, how much leverage is best in trading?

In the next step, please describe the leverage calculation “How much leverage is best?"

In this stage, even if you do not fully understand leverage as well as stop outs, there is no problem.

The FOREX trading company offers free practice accounts, so you can see the actual movement of exchange rates as well as practice and lean how to trade.